PUBLISHED SEPT/OCT 2019

by

Deb Vanasse, Reporter,

IBPA Independent magazine --

Deb Vanasse

Deb VanasseKnowing what to expect from distribution and what to expect when making the switch improves both the experience and the bottom line. Even as the market consolidates, options for independent publishers are within reach.

What Do Distributors Do?

As it applies to publishing, this is something of a trick question. Distributors do distribute books, of course, but they also do much more. "Distributors will actually sell your books into bookstores and to online retailers and gift stores," says Jim Milliot, editorial director at

Publishers Weekly. "They will sell to the book buyers at these places."

Contrast that with Amazon and other online retailers that simply make books available, fulfilling orders but doing nothing to actually get books into stores or promote them aside from publisher-purchased advertising. Contrast that also with companies such as

Ingram Spark that offer print-on-demand (POD) only, and with traditional wholesalers that only stock books and fulfill orders as they're received.

Offering fewer services than distributors, wholesalers are becoming fewer and farther between. That's because wholesaling is a low-margin business, Milliot explains. Requiring extensive infrastructure, they have to be extremely efficient. Nationally, Ingram dominates the market, especially now that Baker & Taylor has narrowed its focus from retail to library wholesaling.

Publishers who want a strong presence in bookstores won't get there by simply warehousing books or making them available for online ordering. "You really, really need a distributor," Milliot says. "You need someone in your corner."

Changing Landscape

Even as more publishers seek distribution, they're finding fewer options. Ingram, which offers distribution as well as warehousing, has purchased the distribution arm of Perseus.

Independent Publishers Group (IPG) bought Midpoint Trade. Big Five publishers such as Penguin Random House, Simon &Schuster, and Hachette are also looking to add scale by growing their distribution businesses, though, as Milliot points out, they usually want clients of some size.

While consolidation limits choice, it also strengthens the distributors that remain. Milliot notes that Ingram, the nation's largest distributor, and IPG, the second largest, have recently invested in improved systems. Even so, he adds, distributors "might be reaching the point where they're as big as they need to be."

The changing landscape can be difficult to navigate. With

Baker & Taylor closing its retail wholesaling operation, publisher Erin Nelsen Parekh at

Drivel and Drool is weighing her options. "As a very small publisher with titles that aren't suited to print-on-demand technology, I am not eligible to work directly with Ingram," she says. "B&T offered nationwide market access and a known name with standard terms."

Now that Baker & Taylor no longer offers what she needs, Parekh is expecting a sharp drop-off in sales as she reconfigures her strategy. Yet possibilities abound. "The switch is making me reconsider a number of options I had dismissed as unrealistic," she explains. "I may collaborate with another publisher, partner with a secondary distributor, or speed up publication plans for a number of new projects in order to remain viable."

When

Hippocrene Books publisher Priti Gress lost key customer service staff, she decided to make the distribution leap. She liked the idea that Perseus was being folded into Ingram, where she already had Lightning Source POD titles. But when the final merger occurred, she discovered that Hippocrene would have to buy back inventory in Ingram's wholesale warehouses. "Though the payments are spread over 18 months, it was still a considerable expense that we did not anticipate," she says.

Gress also had to invest time in learning Ingram's new sales and inventory system. "Now that we have a grasp of it, however, the reporting is excellent and quite useful," she says. Though the company experienced an initial dip in sales as they shifted inventory, Gress reports that sales are now up, including "a considerable rise" in foreign sales.

Wider Than Wide

For publishers who've only made their books available through online retailers, going wide means expanding beyond Amazon. Full distribution offers a chance to go wider than wide.

But publishers face the challenge of getting distributors to take them on. As Milliot points out, it's the proverbial chicken-and-egg dilemma, with distributors looking for a certain volume from publishers before signing them, and publishers needing distribution in order to achieve that volume.

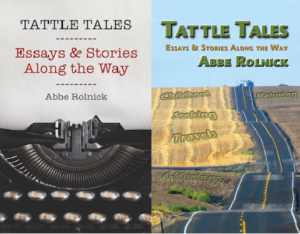

As Abbe Rolnick of

Sedro Publishing discovered, ramping up for distribution can be a multi-year process. Wanting to reach a wider audience than she was getting through CreateSpace and Ingram's POD division, she attended conferences where she spoke with representatives from Small Press United (SPU)/IPG. In order for her to qualify for distribution, they advised her to grow her brand and improve the quality of her product, including the packaging.

Before and after cover designs of Sedro Publishing's novels raise the bar and be accepted by IPG

Before and after cover designs of Sedro Publishing's novels raise the bar and be accepted by IPG

Five years and approximately $8,000 later, Rolnick made the upgrades she wishes she'd made earlier, and SPU/IPG took her on. "The biggest expense was redesigning all books to reflect a compelling and consistent brand," she says.

Upon acceptance, she also spent time and money reworking e-book files, removing titles from online and POD platforms, and finding comparable books and more precise metadata to help the IPG salesforce. With the additional fees and the returns that inevitably come with full-scale distribution, profits didn't immediately rise, but Rolnick is still glad she made the switch.

"As the industry changes, working with SPU/IPG keeps me informed and has added a layer of security as well as knowledge," she says. "Moving to a full-service distributor limits what a publisher can do on its own, but [it also] opens pathways that didn't exist before."

At the Canadian publishing house

Golden Brick Road, publisher

Ky-Lee Hanson also made the switch from retail and POD (Amazon and Ingram) to SPU/IPG. She estimates that training staff and uploading files and metadata, among other expenses, cost the company close to $20,000, but she deems the money well spent.

Within months, the company's books were in dozens of stores. "The bookstores take us seriously now," she explains. "Distribution opens more doors, takes work off our plate, and increases our revenue."

As publishers make the switch, changes to metadata and even "out-of-stock" notices may occur temporarily, Hanson warns, causing a dip in sales. "This was hard for us, as we were launching some new titles and had to manage inquiries and concerns from our authors," she admits. "But within just a few months, it has been worth it."

A Considered Leap

When sales fall short, publishers may be tempted to switch from one distributor to another, a move Milliot advises approaching with caution. "It can be a pain in the neck to change distributors," he says. "You have to get the new distributor's sales force familiar with what your books are and how they can sell them, and there are physical costs associated with moving warehouses. Take your time before rushing into something."

When Amanda Broder founded

Ripple Grove Press, she initially distributed with Midpoint Trade, then switched to IPG even before IPG bought Midpoint. "We wanted a distributor that had a larger reach, one that would be more aggressive in marketing our books, and had more name recognition in the industry," she says. "Overall, it was a great move, even if we did have to sink a lot of money into the shipping of inventory."

At

Stone Bridge Press, publisher Peter Goodman switched distributors back in 1998. "The company we were with was not doing a good enough job, so we had to find something new," he explains. "We got lucky finding our current distributor because we happened to publish a book that was one of the favorite books of the CEO at the time."

Making the switch, Stone Bridge incurred considerable costs, Goodman says, including legal fees, disposal of books not making the transfer, travel time to establish new relationships, adjustments in accounting and bookkeeping, returns created when the previous distributor closed out accounts, and "much psychic wear and tear."

But the change was for the best. "We went with a much more professional and powerful company, and it only made us stronger," Goodman says. "[It] opened us up to a whole new network of accounts, both domestic and international."

For publishers who decide to change distributors, Goodman advises building in ample time to get everyone on board. "Pay attention to details," he says. "Look at the contract carefully and note especially what is different and how that might impact your administration, workflow, and revenue. Make sure everything is written down, and be prepared for the distributor to be inflexible on contract terms. Find one person at the new company you can work with to manage your details through all their departments. Also, realize that the honeymoon period will last only a couple months."

The bigger the list, the tougher the transition, Goodman says, noting that publishers should have additional cash reserves on hand for a six-month transition period. He advises publishers to give notice of the change to all their accounts and follow up again after the switch.

"Be sure there is no lapse in when books stop being sold by one place and start being sold by the next," he suggests. "The new distributor should offer you a kind of welcome package where they send out a special announcement to all their accounts, and perhaps even a promotion on your books to start them off. If they don't offer such a package, suggest one."

An Ongoing Process

Finding the right distribution for your titles requires time, effort, and money, but as long as you've done your homework, the effort will yield results. "If you're not feeling your distributor for whatever reason, then you need to make the switch," Broder says. "It takes a long time to finalize everything, so get started right now."

The more publishers put into the process, the more they'll get out of it. "Going deep into metadata, understanding the backend of bookstore purchases and returns, and finding readership and exposure is important, no matter who distributes books," Rolnick says.

Meeting with distribution staff at conferences is a smart way to ensure titles continue to get the attention they deserve. "Giving their sales staff and client managers a good sense of our list has been an ongoing process," Gress says. "Face time with distributor staff has been key. They handle many clients, and it has been important to get and keep attention on our products."

Knowing what to expect from distribution and what to expect when making the switch improves both the experience and the bottom line. Even as the market consolidates, options for independent publishers are within reach.

Co-founder of 49 Writers and founder of the author co-op Running Fox Books, Deb Vanasse is the author of 17 books. Among her most recent are the novel Cold Spell

and a biography, Wealth Woman: Kate Carmack and the Klondike Race for Gold.

She also works as a freelance editor.